Please note: all opinions are my own. I have limited consultancy capacity going forward, please email oliver.adam.ring[at]gmail.com

We’re nearly two years on from the announcement that gambling powerhouse Entain was to acquire ‘boutique’ esports betting company Unikrn for the small sum of £50 million.

That also means we’re nearing the three year anniversary of the SEC charging Unikrn US$6.1 million for conducting an ‘unregistered initial coin offering (ICO) of digital asset securities’.

“According to the order, the Commission considered these undertakings, as well as Unikrn’s financial condition and the fact that the penalty represents substantially all of Unikrn’s assets, in accepting Unikrn’s offer of settlement”

Far from the point of this Substack, but perhaps £50 million is considered too small an investment for the Entain M&A Due Diligence team to get wheeled out in full force.

Entain took Unikrn off the market, promising investors that there’s US$20bn+ in Total Addressable Market by 2025. Analyst forecasts may need some serious adjustment when they actually look at performance.

The betting brand relaunched in December 2022 after being hauled offline, with the corporate line being Unikrn deciding “what strategy would ultimately not only serve our new and growing list of customers, but also Entain”.

‘Skill-based wagering’ and ‘Moneymatch’

When Entain CEO, Jette Nygaard-Andersen chirped on acquisition: “One exciting opportunity is the growing esports skill-based wagering market.” Non-sensical b*llocks.

The first ‘unique’ feature to Unikrn is ‘Moneymatch’. You guessed it, a P2P wagering system for video games!!

Whoever advised, or briefed Entain on esports and the opportunity was so, so, so far off the mark, in my opinion. The esports opportunity is bringing in users with low CPA, and a gradually increasing ARPU.

When I was at Uni we used to play FIFA tournaments, £5 all in, winner takes all. No need for a ‘peer-to-peer’ platform which takes a rake for facilitating a wager. Esports, by its very nature, provides those who are exceptional at the game with a path to monetisation through a well-funded competitive circuit (ignoring the pitfalls of EA Sports esports structure for now).

Years ago, professionals used to enter Virgin Gaming tournaments purely to try and be able to have a career playing FIFA. The existence of organisations, and the keen attitude of football clubs to take FIFA players under their wing now means the best of the best don’t need to play 3rd party platform wagered games to simply keep themselves afloat.

If looking at the likes of Counter-Strike, FACEIT and ESEA dominate the ‘private’ matchmaking service, with 128 tick servers over 64, enhanced (dubious) anti-cheat systems, and a well structured ranking system. They are heavy on infrastructure and far from easy to achieve and roll-out. Dota, despite being another Valve property and potentially lending itself to FACEIT, never managed to garner the same support or success.

The design of a ranked system in itself often provides enough reward for players in competitive games like Dota, CS:GO and League of Legends. FIFA of old (pre-Ultimate Team) simply had no overall leaderboard or esports structure - online was simply there to facilitate player versus player games. If a P2P wagering system struggled back then, it’s not going to do any better now.

So, if you herald from the Poker industry and think the business model is applicable, it’s simply not. You’re wasting your time.

Social gaming and esports undoubtedly should be a key pillar of any operator’s strategy going forward; I just hope that it’s approached and implemented in a far better manner than what we’ve seen so far from Entain.

‘UMode’

Social gaming meets COMPETITIVE GAMING! ESPORTS!

Bet on yourself playing ranked games.

Absolutely f*ck all to do with esports.

Anti-competitive, game ruining crud that shouldn’t be allowed.

Other operators have previously claimed to be fabulous by offering markets on high profile Streamers public matchmaking games. It wasn’t long before the lobbies were bombarded with people intentionally throwing games, or smurfing above their level to win their wager.

UMode is the same (almost). It allows you to bet on yourself.

Why is this an issue?

Let’s make a little list of things:

You can get your better mate to play for you, because you’ll win the wager! (Let’s ruin a game for 9 other people by letting my GLOBAL ELITE pal play my Silver I game)

Unikrn will just limit you if you win a couple of games. It’s opaque.

If you lose games, your odds will increase, enticing you to continue playing. Ranked games are often best played with a clear state-of-mind, so encouraging players on a loss-streak to continue wagering and playing is simply bad practice. (Call me a snowflake)

“Your UMode odds are personalized based on your performance across ranked matches. As you play, your odds will change to reflect your likelihood of winning a bet. These changes will be made at Unikrn’s discretion for a variety of reasons, including meeting regulatory, privacy, risk management and legal obligations. In order to prevent abuse, Unikrn cannot disclose the Version 0.2: Initial Relaunch Rules November 30th, 2022 reasons specific odds or limits are provided to individual users.”

Botched Brazilian sponsorship

With the financial muscle of Entain, it was only a matter of time before Unikrn started to flex the sponsorship muscle.

With Betway’s esports team all moving on to pastures new, esports seems to be on the backburner for now, and thus sponsorship inventory has freed up considerably.

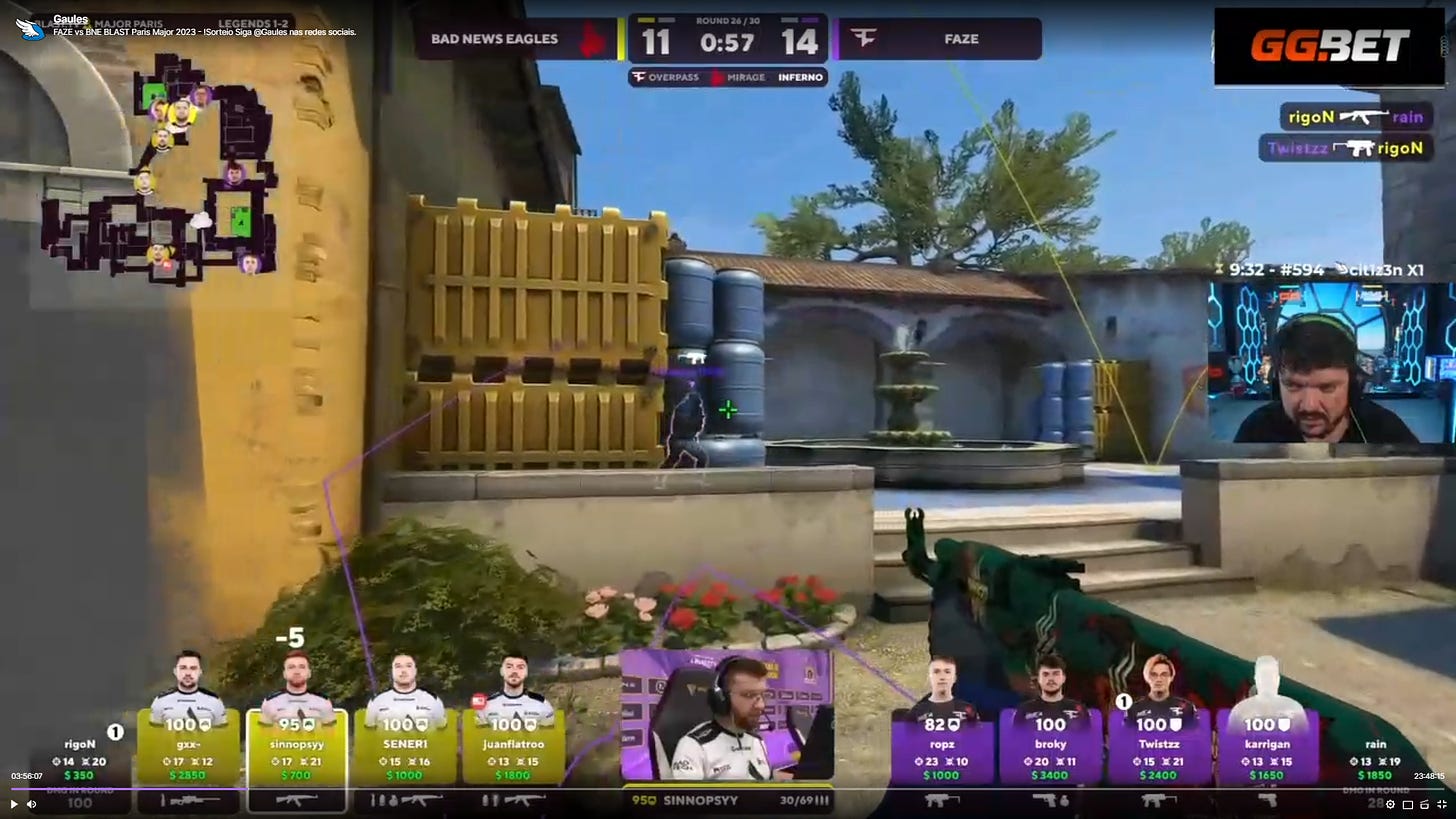

Unikrn has launched initially in Brazil and Canada, and most recently signed a sponsorship deal with BLAST, including the final ever CS:GO Major, ongoing in Paris.

By shelving the brand for over a year, the social media presence and decent content legacy has disappeared, with interaction tending to come between the brand’s triangle of company accounts.

The multi-year sponsorship of BLAST shows a deep commitment to esports, but the Paris Major has again gone to show that everything they’re doing is a little ‘territory-grab’ and ill-considered.

Clearly from the above, the advertisement shown on Blast’s Twitch is for Brazil (Real the currency, mention of Portuguese). However, the Gaules (Portuguese broadcaster of the Major) sponsorship is carved out from the main co-stream. The Portuguese stream, attracting similar peak viewership (~150k concurrent, on EU timezones) is sponsored by GG.Bet.

The rest of the branding is identical (as per the co-stream contract), yet the agreement with Gaules allows Portuguese specific sponsorship. Ironically, Gaules has two gambling sponsors: GG.Bet and Flutter owned Pokerstars.

Competitors and the esports betting landscape

When Entain threw its hat in the ring with such financial heft, brands like Rivalry (Brazil and CA too) should have been quaking in their boots.

I envisaged seeing a bedraggled Steven Salz, Cody Luongo and Kevin Wimer creeping out of a bombarded Rivalry bunker. Instead they’re sipping Caipirinhas atop a lofty perch and remain a good example of how to build an esports book, and how an esports strategy should be executed.